The Single Strategy To Use For Short Term Loan

Wiki Article

The Best Strategy To Use For Short Term Loan

Table of ContentsShort Term Loan - QuestionsUnknown Facts About Short Term Loan4 Easy Facts About Short Term Loan DescribedShort Term Loan Things To Know Before You Get ThisSome Ideas on Short Term Loan You Need To KnowSee This Report about Short Term Loan

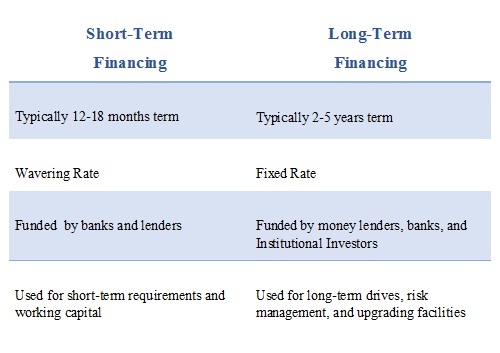

In circumstances like these, many individuals count on short-term lendings or short-term funding as a means to pay for unexpected or tough personal costs. Temporary funding is a loan option that offers the recipient borrowed funds for momentary costs, comparable to how a short-term finance functions!.?.!? Brief term car loans provide you obtained resources that you repay, plus interest, generally within a year or less.A big benefit of brief term financing is that they can make a huge distinction for people that need immediate accessibility to money they do not have. Short term finance lending institutions do not put a big emphasis on your credit rating for approval. More vital is proof of employment and also a consistent earnings, info regarding your bank account, and proving that you do not have any type of outstanding fundings.

Several kinds of short term lendings deal incredible flexibility, which is practical if cash is limited today however you anticipate points improving economically quickly. Before signing for your short-term funding, you and the lending institution will make a timetable for settlements and also concur to the interest rates in advance.

All about Short Term Loan

The advantage of short-term funding is that you obtain a reasonably small quantity of money right now, and also you pay it back swiftly (Short term loan). The total rate of interest settled will generally be much less than on a larger, long-term lending that has more time for rate of interest to build. No financial solution is ideal for each debtor.

This is why it is essential to evaluate your alternatives in order to set on your own up for success. Take a look at the 3 top downsides of taking out a short-term loan. The largest downside to a short-term car loan is the rate of interest, which is higheroften a lot higherthan rate of interest prices for longer-term car loans.

The Facts About Short Term Loan Uncovered

In addition to repaying the temporary financing equilibrium, the passion settlements can result in greater repayments each month (Short term loan). Keep in mind that with a temporary car loan, you'll be paying back the lending institution within a brief period of timewhich means you'll be paying the high interest for a much shorter time than with a long-lasting car loan.Long-lasting fundings may have reduced rate of interest, however you'll be paying them over numerous years. So, relying on your terms, a temporary funding may really be more affordable in the long run. While settling a brief term financing in a timely manner according to your set routine can be a significant increase to your credit history rating, stopping working to do so can cause it to drop.

This can be harmful if you only have a little or excellent credit rating, and devastating to your future possibility to borrow if you currently have inadequate credit score. Prior to obtaining a short-term finance, be sincere with on your own concerning your see page capacity and here also discipline when it involves repaying the financing on time.

All about Short Term Loan

Thinking about the leading advantages as well as negative aspects of brief term loans will certainly help you choose if this financial tool is best for your situation. The debtor returns the quantity of the lending to the lender over the program of months rather than years., you can conveniently apply for a lending either online or with a bank or credit rating union.The needs for obtaining a financing are: The debtor ought to be 18 years or above Legitimate e-mail address and also telephone number Although these are some of the requirements that you might require to meet before obtaining a funding, you do not require to have security while getting a loan.

The 3-Minute Rule for Short Term Loan

There are several advantages linked with short-term fundings. Let's discuss them to aid you recognize just how useful these lendings can be.

With short-term loans, you also get help in improving your credit ranking. As you are getting a temporary lending, you should be positive sufficient to settle it in the needed duration. Thus, users of temporary fundings frequently gain lines of debt. The most eye-catching and also useful function of temporary car loans is that they provide flexibility and benefit.

Facts About Short Term Loan Uncovered

Lots of loan providers run websites that you can see directly to look for a loan quickly. Considered that you have to pay back the finance within a brief period, the tension connected with settling it will not last for long! These are all the benefits that short-term fundings supply. If you remain in urgent need of money, what are you waiting for? Go as well as get the loan to derive its benefits.You can simply get a lending as well as repay it as quickly as you earn sufficient profit.

Report this wiki page